Accuracy is essential to every step of the property insurance claims process. From initial inspection to settlement, an estimate's quality determines the outcome's speed, cost-efficiency, and fairness. One of the most overlooked yet impactful factors is accurately identifying the property’s jurisdiction, which is critical for applying the correct building codes and permit requirements. Estimates based on incorrect or incomplete data can lead to costly errors, inflated supplements, regulatory risk, and delays. Ultimately, inaccurate estimates erode operational efficiency and undermine the policyholder’s trust when it matters most.

The Hidden Cost of Inaccurate Claims Estimates

Consider the scenario: a widespread hailstorm impacts a metropolitan area like Dallas. A common challenge arises when properties' mailing addresses don't align with their actual governing jurisdiction. In fact, a staggering 53% of all properties in the US are not in the city's jurisdiction in their mailing address. This means that when attempting to verify codes, there's less than a flip of a coin's chance of contacting the correct municipality.

An "all hands on deck" approach is vital during serious storm events. This often means rapidly deploying teams who might not be intimately familiar with every local jurisdiction and its specific processes. In these precious, high-volume moments, every second counts. The geographical disconnect described above, exacerbated by the urgent deployment of diverse teams, can lead to critical delays and inaccuracies when identifying the correct local authority.

This discrepancy between a property's mailing address and its true governing jurisdiction has a very real financial impact. When the incorrect local authority is consulted, it leads to significant inaccuracies in claim estimates and payouts. This leakage stems from discrepancies in required line items (like ice and water shield or drip edge) and even differing local sales tax rates. Such errors can amount to hundreds or thousands of dollars on a single claim, and compounded across an entire book of business, the financial impact on indemnity payouts is substantial. When you have accurate codes, you ensure accurate claims payouts, driving efficiency and trust.

OneClick Code: Your Foundation for Accurate Claims Payouts

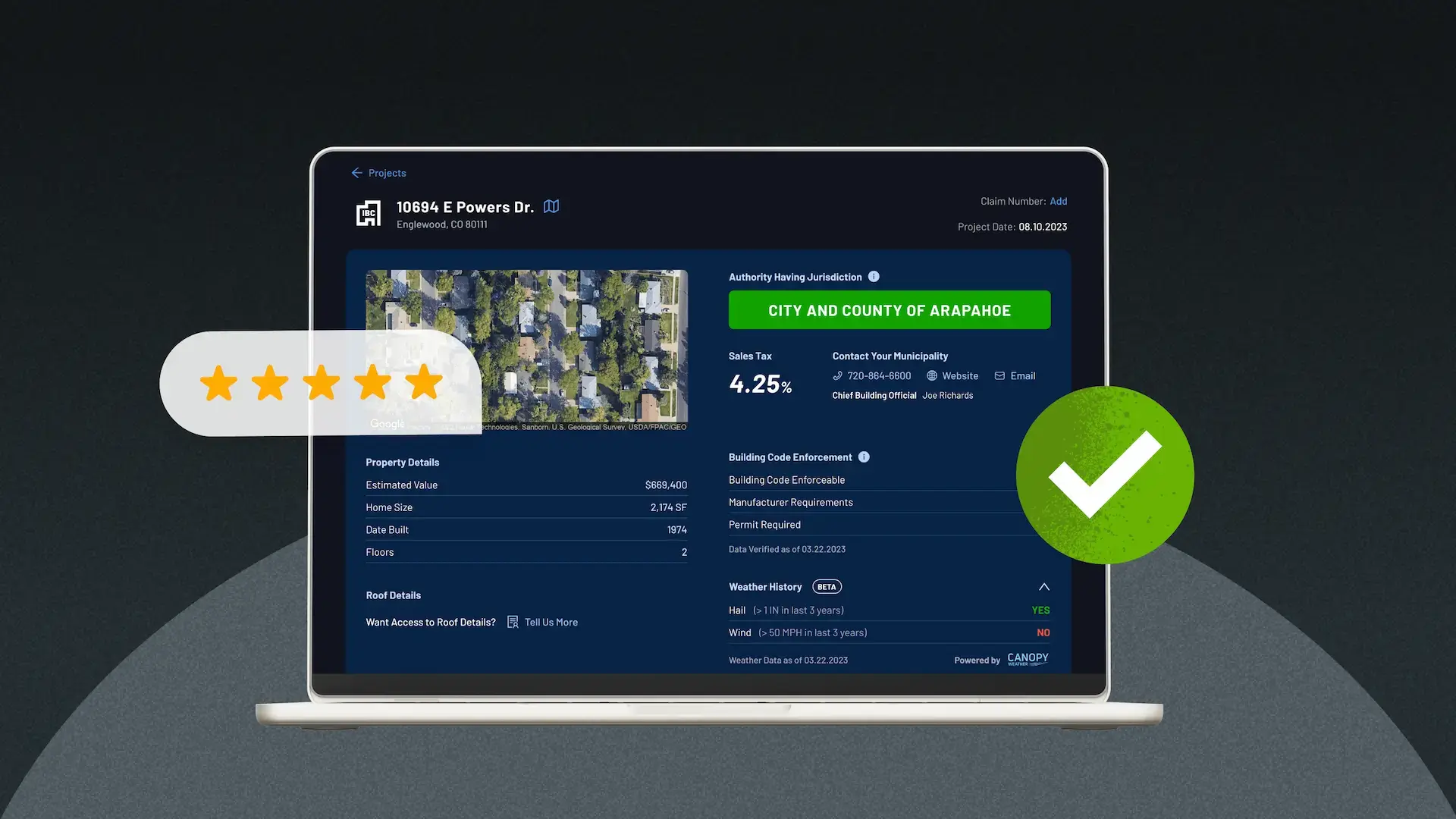

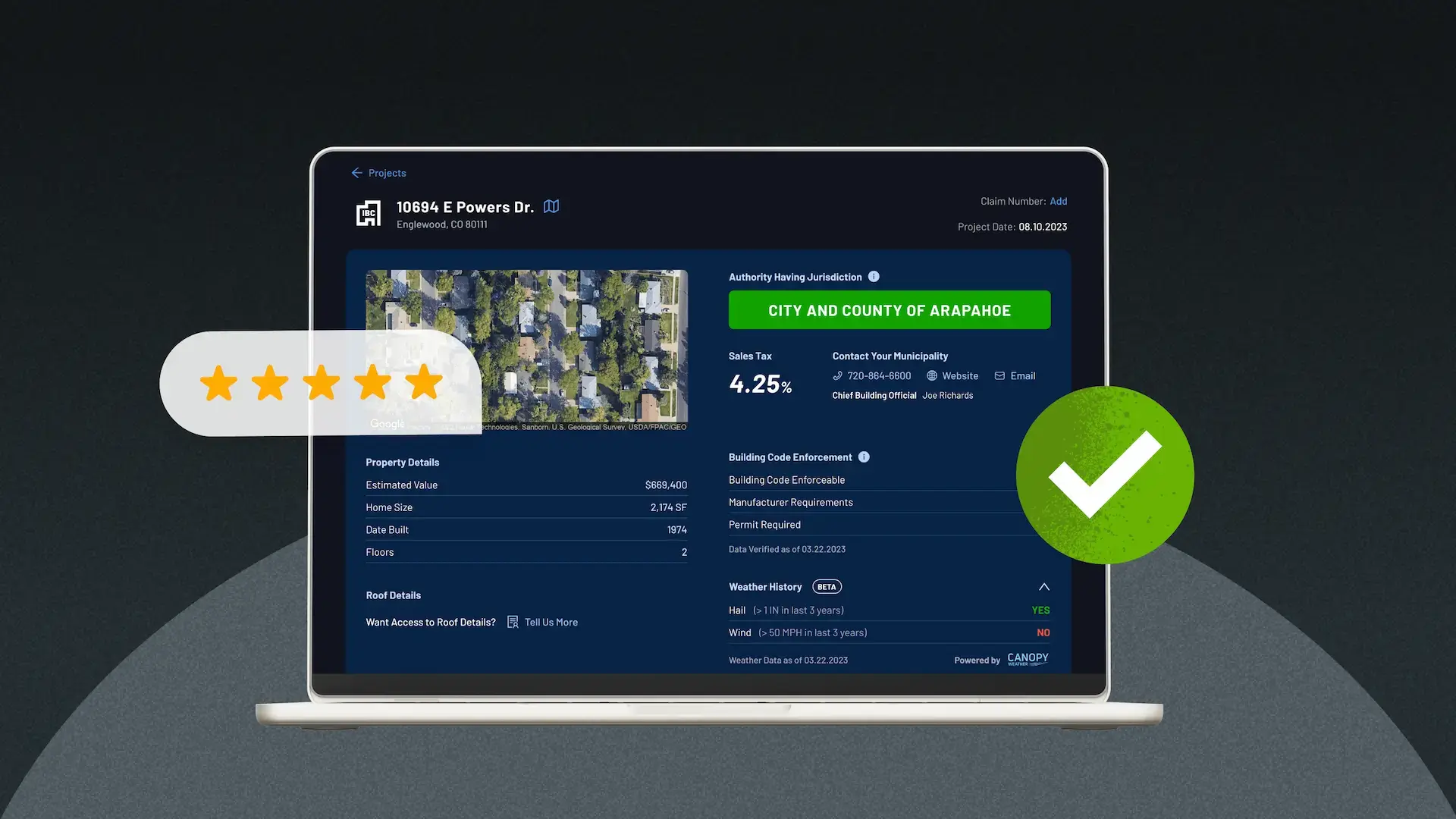

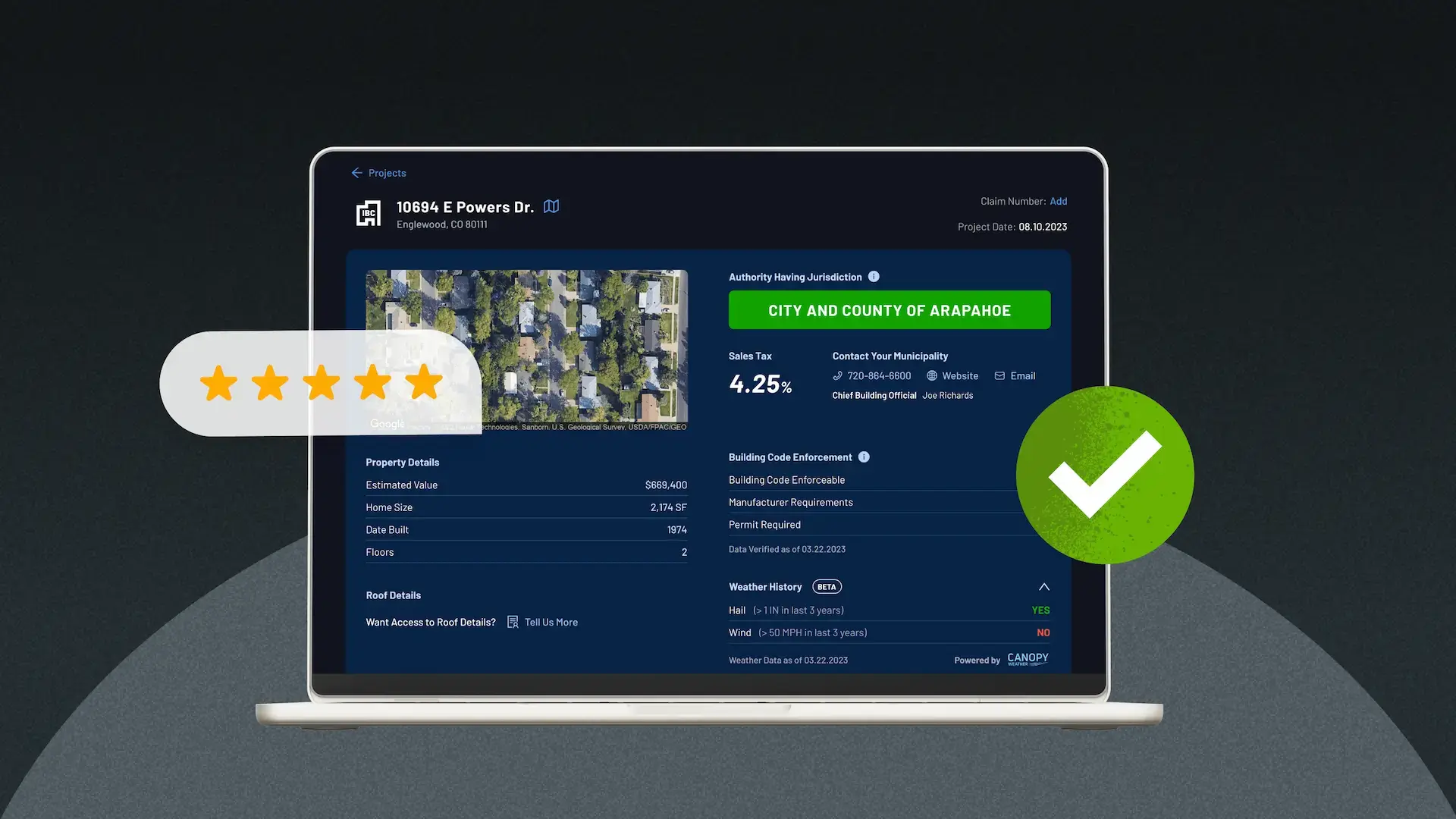

OneClick Code was created to solve one of the biggest challenges in property insurance claims: the lack of consistent, accurate building code data at the time of the estimate. Our technology delivers verified, jurisdiction-specific data—automated, defensible, and seamlessly integrated—so claims are paid correctly from day one, reducing errors, disputes, and associated costs.

Instant Access to Accurate, Jurisdiction-Specific Building Code Requirements

With just an address, OneClick Code delivers accurate and instant building code requirements based on the correct jurisdiction, significantly increasing the accuracy of claims settlement. Our core value truly lies in this fundamental precision, ensuring consistency across every claim.

Precise Jurisdiction Identification:

OneClick Code collects and maintains data from over 32,000 municipalities nationwide, providing instant access to accurate, address-specific data. This unique approach ensures that the correct local regulations are applied to every property, eliminating the common pitfalls of misidentified jurisdictions.

Enforceable Code Data at Your Fingertips:

OneClick Code provides verifiable building codes and supporting documentation for code-related decisions. This accuracy streamlines approvals, reduces ambiguity, and ensures claims are settled correctly the first time, preventing discrepancies.

Fewer Supplements, Faster Resolutions:

Inaccurate or missing code information is a leading cause of supplements. By resolving these issues upfront with precise data, OneClick Code significantly reduces the number of additional requests and rework, drastically shortening claim cycle times without compromising accuracy.

The Bottom Line: Claims Accuracy and Efficiency

At the core of OneClick Code is a simple but powerful value: getting estimates right the first time. By automatically identifying the correct jurisdiction and applying accurate building codes at the outset, our technology enables precise, defensible claims from day one. This accuracy reduces unnecessary supplements, minimizes rework, and streamlines resolution, ultimately improving operational efficiency and financial performance. Carriers using OneClick have seen significant reductions in overpayments and claim variability, contributing to a 10x average ROI driven by consistent, scalable claims accuracy.

OneClick Code helps you create estimates quickly with real-time, accurate building code data so you get paid faster.